Core concepts

What is x(3,3)?

To understand how x(3,3) works, we need to first understand ve(3,3) (metaDEX):

Origins of metaDEX

Andre Cronje revolutionized exchanges by creating a system where all participants are incentivized to act in the best interest of each other and the exchange. While not perfect, it was a huge step forward as a means to align incentives with participants.

Modern implementations have proven metaDEX can achieve massive scale and sustainable revenue, but they rely on artificial restrictions to maintain participation. x(3,3) represents a fundamental reimagining—instead of forcing compliance through locks, x(3,3) creates strong incentives where users want to stay because the system rewards active participation and naturally concentrates value among those who contribute most. To understand metaDEX and ve(3,3), we need to break down two key concepts:

Rebase

A core element of the ve(3,3) model was the rebasing of locked positions to prevent a user from being diluted by emissions, OHM (3,3). This anti-dilution mechanic for veTOKEN holders allowed them to maintain the same ownership without having to buy and lock more tokens.

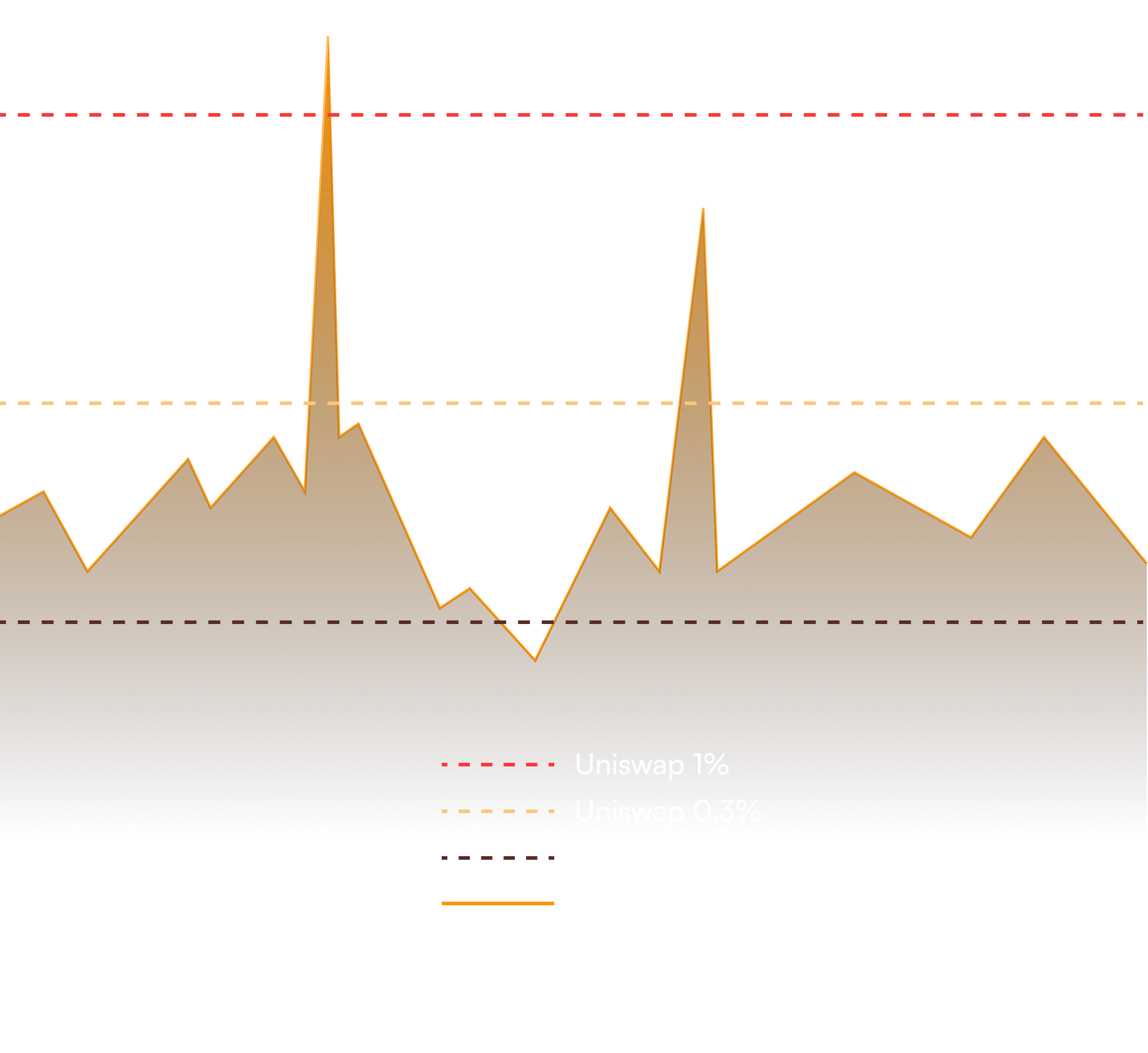

Here is a crude visual representation of it in action:

xSHADOW addresses dilution with a unique "PVP Rebase", which acts both as dilution protection and additional yield. Instead of minting new tokens to locked positions, x(3,3) does two things:

- xSHADOW stakers earn value from protocol fees and voting incentives.

- xSHADOW allows holders to exit early, sacrificing their voting power. The forfeited underlying tokens are streamed to existing stakers proportional to their positions.

Vote Escrow (ve)

The second concept you should understand is vote escrow (ve)—a fundamental change to governance and on-chain voting systems that introduced time-weighted voting.

Instead of voting with token amount a, tokens are lockable in a VotingEscrow, now shown as veA, for a selectable locktime

Your vote is not only calculating total tokens held, but also the lock duration. Curve first introduced this in a 2020 whitepaper.

A visual representation can be seen below:

This system intentionally creates a risk vs. reward scenario. where more governance power is given to active participants continually extending their locks. x(3,3) has a similar decision matrix, but users do not have to lock tokens to participate.

ve(3,3) ➡ x(3,3)

ve(3,3) has a flaw: the absence of an exit mechanism means it relies on static commitment rather than dynamic value creation. Without such a measure, the system accumulates dead voting power, as users hold veTOKENs indefinitely without active participation, still influencing the protocol without contributing to its success. Even the most successful metaDEXs require upfront commitments to earn meaningful rewards, creating a system driven by obligation rather than value. Users can exit xSHADOW at any time, which transforms the incentive structure from a lock-up trap to active participation motivated by real value.

Now that you understand ve(3,3), the question persists:

How does x(3,3) improve this?

xSHADOW is where x(3,3) shines by creating a incentive system that responds to real user behavior. While traditional metaDEXs create value through artificial scarcity and forced commitments, x(3,3) generates value through genuine user activity. When users exit, their value flows to remaining participants. This creates a dynamic system where rewards scale with protocol success and ownership naturally concentrates among those who contribute most value, scaling Shadow without requiring artificial lock-ups or arbitrary restrictions.

Exit mechanism

Shadow implements a unique exit rebase where exit penalties are streamed to xSHADOW stakers. When users exit their xSHADOW position early, 100% of the forfeited tokens are streamed to existing xSHADOW stakers proportional to their positions. This creates a powerful incentive structure where:

- Rewards scale with the protocol (user activity)

- Strong incentives to stay instead of locks

- Removes the need for locks or wrappers

- xSHADOW solves the need for token lock-ups

- $x33 (Liquid staked xSHADOW) solves the need for liquid wrappers

Previous DEX Limitations

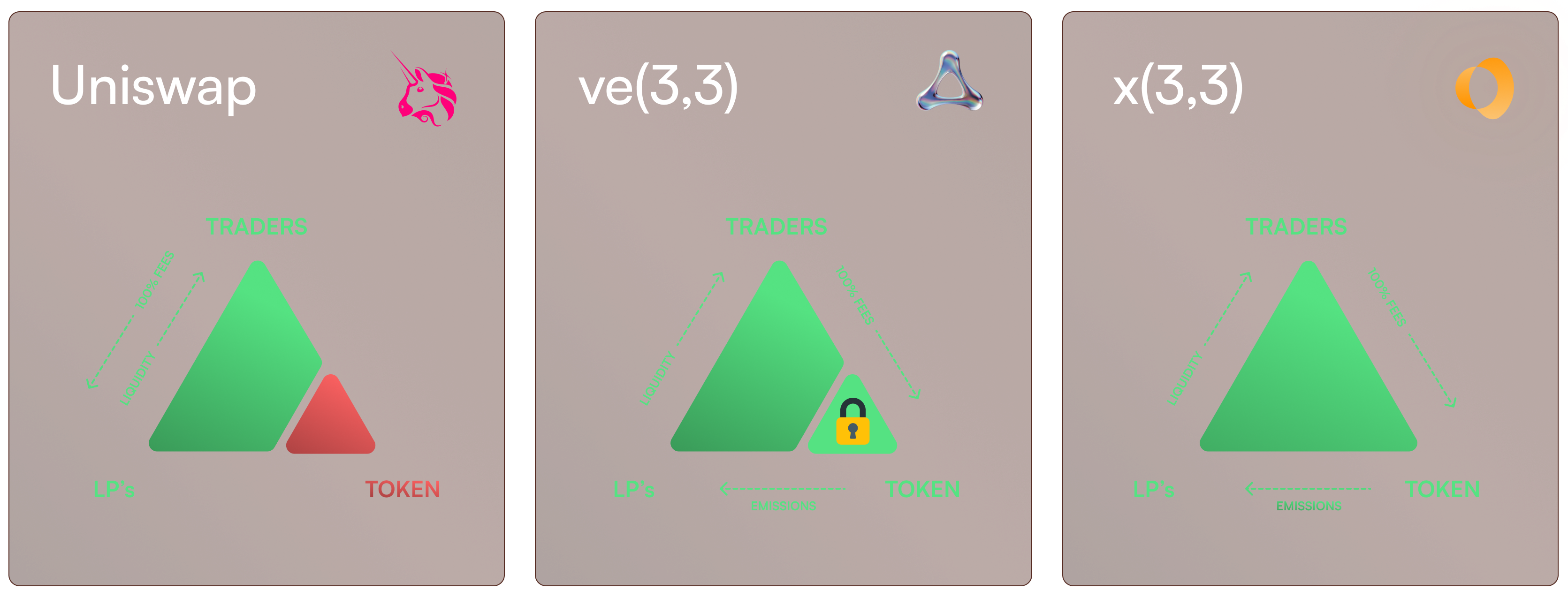

The history of decentralized finance has been marked by repeated attempts to solve the "DEX Trilemma" - the challenge of aligning incentives between traders, liquidity providers, and token holders. While Andre Cronje's metaDEX model theoretically solved this by balancing incentives between all participants—long lock-ups created a high friction system that forced users to lock tokens to participate equitably in the incentive model.

Credit to the Aerodrome team for the original graphic and concept.

Uniswap focused on a simple two-party system: traders and liquidity providers (LPs). ve(3,3) improved this by properly aligning incentives with token holders as well, but access to those incentives was unfair and heavily skewed towards protocols.

| Uniswap | ve(3,3) | x(3,3) |

|---|---|---|

|

|

|

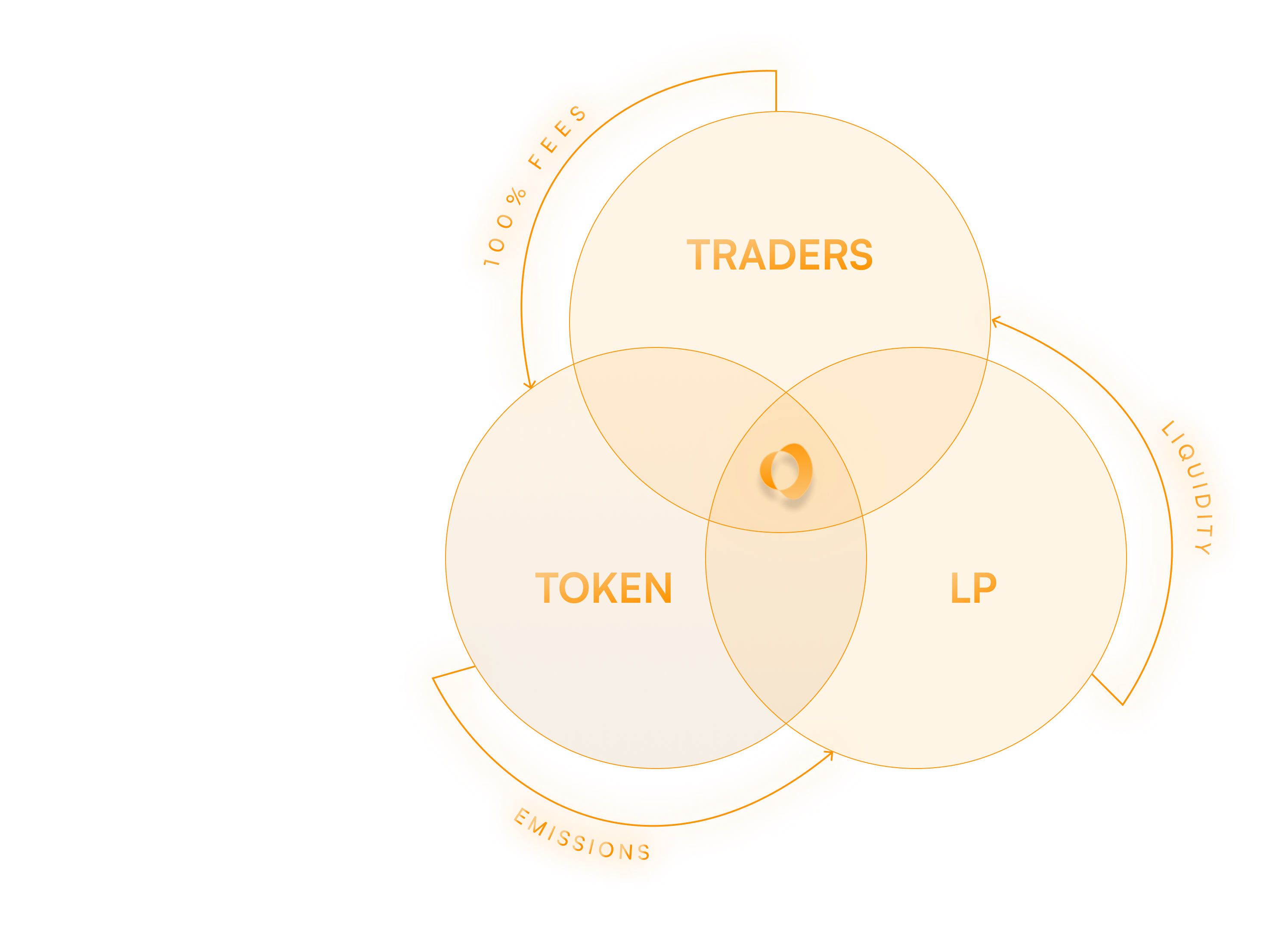

The result? A more fluid and accessible system that still provides strong incentives, while removing much of the friction that still plagues ve-token models (token lock-ups).

| Traders | Liquidity Providers | xSHADOW |

|---|---|---|

|

|

|

Directing Emissions

As discussed in our DEX Trilemma, prior to the metaDEX users had no choice but to suffer from misaligned incentives from centralized parties. This led to inefficient capital allocation and reduced long-term sustainability for exchanges. x(3,3) solved this by putting emission control directly in the hands of xSHADOW stakers who are incentivized to optimize for value.

Directing emissions is an extremely powerful use case for xSHADOW stakers as it gives the holders primary power over what the platform incentivizes. If a token continually underperforms via fees, xSHADOW holders are going to be less incentivized to vote for it, reducing incentives to it.

Less rewards from the pool = less emissions = less liquidity.

Each week, in what we call Epoch, xSHADOW stakers make a choice on what liquidity pools to direct rewards to. Based on that vote which concludes every Thursday 00:00 UTC, SHADOW emissions are then directed to the chosen liquidity. You can read more about voting and how emission distribution is calculated here.

Voters earn swap fees and vote incentives in a lump sum immediately after epoch flip. These rewards are based on the liquidity you voted for in the previous epoch. If you vote for a liquidity pool in Epoch X, you will receive your accumulated rewards instantly when Epoch Y begins, proportional to your vote compared to the total votes.

Vote Incentives

On Shadow we utilize two different types of vote incentives: liquidity pool incentives & voter incentives. A vote incentive can be in the form of ANY whitelisted token. As a protocol, incentivizing your liquidity will attract voters and result in higher directed emissions. As an xSHADOW staker, you earn a portion of the incentives.

A voter incentive is designated at anytime during the current Epoch and paid out in lump sum to xSHADOW voters. It is displayed after the incentive is made and will influence votes until Epoch rollover.

A liquidity incentive is another method protocols can use to attract liquidity provision. This incentive is distributed directly to liquidity providers and is a great way to bootstrap new liquidity on the platform.

| Voter Incentives | Liquidity Incentives |

|---|---|

| Paid as lump sum at epoch start | Distributed over 7 days after epoch |

| Designated during current epoch | Used to boost pool visibility (direct yield) |

| Influences votes until epoch rollover | Helps bootstrap new tokens |

| Distribution | |

| To voters at epoch flip | To LPs for full week after epoch |

Be in the know!

A vote incentive can be in the form of any whitelisted token, and must be applied to only active gauges. Be sure to read & understand voting before participating.

Fees

Shadow's x(3,3) model takes a straightforward approach to fee distribution:

- 100% to xSHADOW holders - All protocol fees flow to active governance participants

- MEV revenue - Arbitrage profits from privileged infrastructure also flow to xSHADOW holders

This creates a powerful flywheel where:

- High-performing pairs generate more fees and MEV opportunities

- xSHADOW stakers are incentivized to vote for productive liquidity

- Increased emissions attract deeper liquidity

- Deeper liquidity drives more volume, fees, and arbitrage opportunities

Speaking of swap fees!

Fee-Split

Fees-splits can be configured per gauge, below are the default fee-splits for all liquidity types:

| With Gauge | No Gauge |

|---|---|

| 100% to xSHADOW | 0% to xSHADOW |

| 0% to Liquidity Providers | 95% to Liquidity Providers |

| 0% to Protocol | 5% to Protocol |

Configurable Ratios

Just like how our fees adjust to market volatility and volume, giving high-volume liquidity their fees back is just good business.

Example memecoin fee-split:

- 80% of fees go to xSHADOW

- 15% creator fee (only memecoin launchers)

- 5% goes to LP

Dynamic Fees

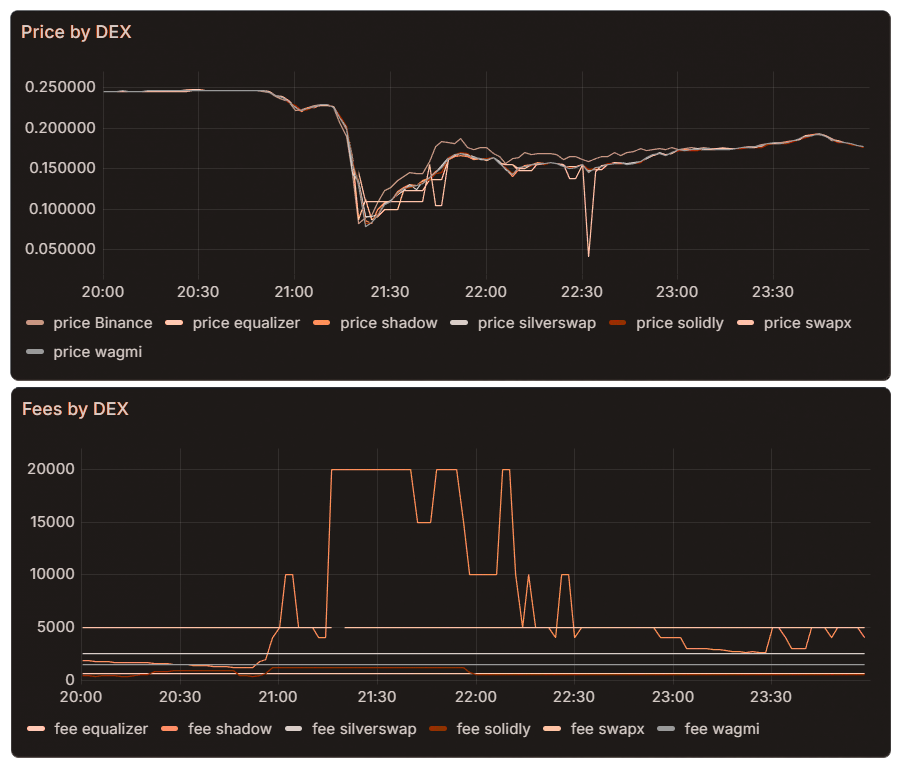

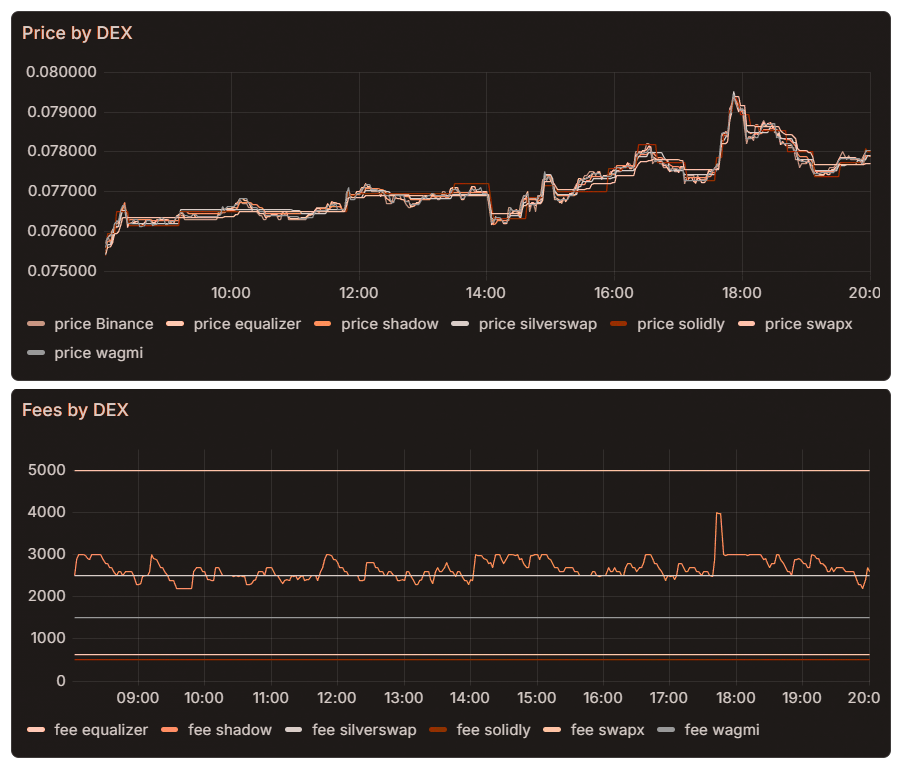

Shadow's algorithm automatically adjusts fees based on market conditions and trading volume, providing maximal protection for liquidity providers while capturing the highest possible trading fees. Thanks to FeeM, fee adjustments can happen as frequently as every 30 seconds, enabling highly responsive fee optimization.

Below is a visual of Shadow's dynamic fees versus other exchanges:

While dynamic fee mechanisms are not entirely novel, Shadow's dynamic fee algorithm monitors both DEX and CEX volume inflow, including major centralized exchanges. This comprehensive monitoring leads to better performance, higher fees, and reduced adverse selection costs. This is further enhanced by our MEV protection suite that captures arbitrage across Sonic and cross-chain venues.

Real-Time Market Protection

Our algorithm is highly responsive, capable of adapting its parameters on sub-minute time scales. This rapid reactivity provides robust protection during periods of extreme volatility, as demonstrated during recent market crashes where the algorithm successfully ensured maximal protection of LP positions.

During volatile periods, the central objective is to shield LPs from excessive toxic flow while simultaneously capturing the highest possible trading fees. The algorithm continuously monitors:

- Relative liquidity distributions across venues

- Price deviations and typical trade sizes

- Real-time on-chain and market data

- Cross-venue volume patterns

During stable markets, the focus shifts toward maintaining a smooth trading experience and optimizing fee collection from non-toxic order flow. Since we continuously compete with other DEXs for volume, maintaining an optimal balance between fee level, liquidity depth, and spot price is crucial.

| Fee Range | Market Conditions |

|---|---|

| Base: 0.05% Cap: 1.00% | Normal market conditions, Stable trading pairs, High liquidity pools |

| Base: 0.30% Cap: 2.00% | Less liquid pairs, Higher volatility, Complex trading pairs |

| Up to 5.00% | Extreme market conditions, Flash crash protection, MEV resistance |

Our team continuously monitors and optimizes the algorithm, implementing specialized algorithms for different pool categories including volatiles, stables, LST (Liquid Staking Tokens), and meme pools, with novel approaches that account for trading patterns, redemption mechanics, liquidity cycles, and cross-protocol dynamics.

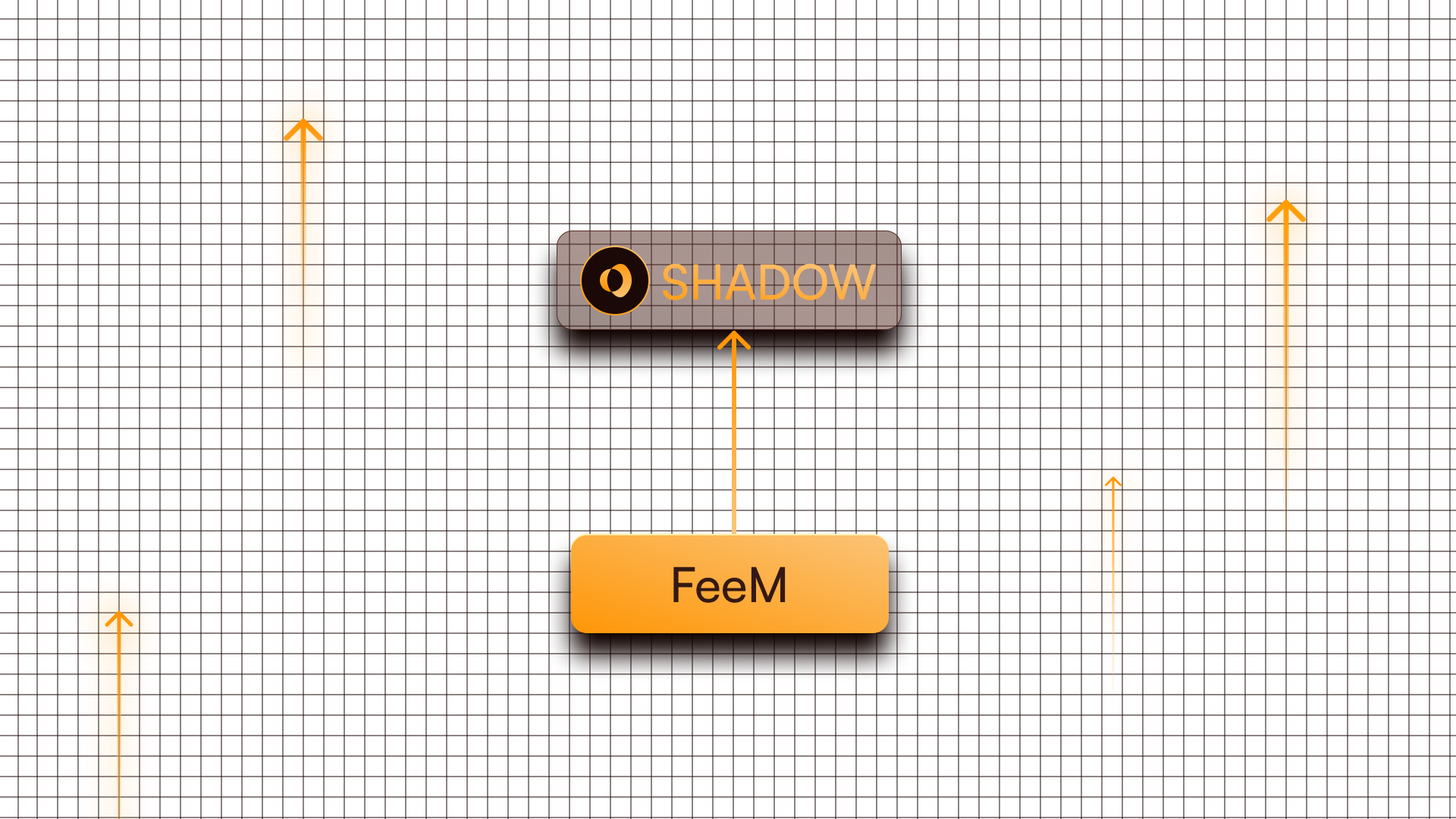

FeeM (Fee Monetization)

FeeM (Fee Monetization) is Sonic's innovative program that returns 90% of the gas fees a protocol generates back to the developer. This creates a powerful incentive structure where protocols can reinvest gas costs into enhanced functionality.

| Traditional Networks | FeeM Protocols |

|---|---|

| 50% of fees are burned | 90% of fees returned |

| 45% go to validators | 10% to validators |

Shadow Exchange leverages FeeM's gas refunds to enhance protocol efficiency in two key ways:

| Dynamic Fee Adjustments | MEV Protection |

|---|---|

| Frequent fee updates (as often as every second) to optimize fees based on market conditions. | Arbitrage protection bots that capture price discrepancies before external MEV bots. |

By receiving 90% gas refunds through FeeM, we can continuously run these operations without concern for transaction costs. This results in:

- Better price execution across all liquidity

- Reduced adverse selection costs for LPs

The captured value is returned to the ecosystem through vote incentives, ensuring value stays within Shadow.