Core concepts

Concentrated Liquidity

What is it?

First pioneered by Uniswap V3, concentrated liquidity enables liquidity providers to focus their capital within specific ranges, dramatically improving spread and slippage.

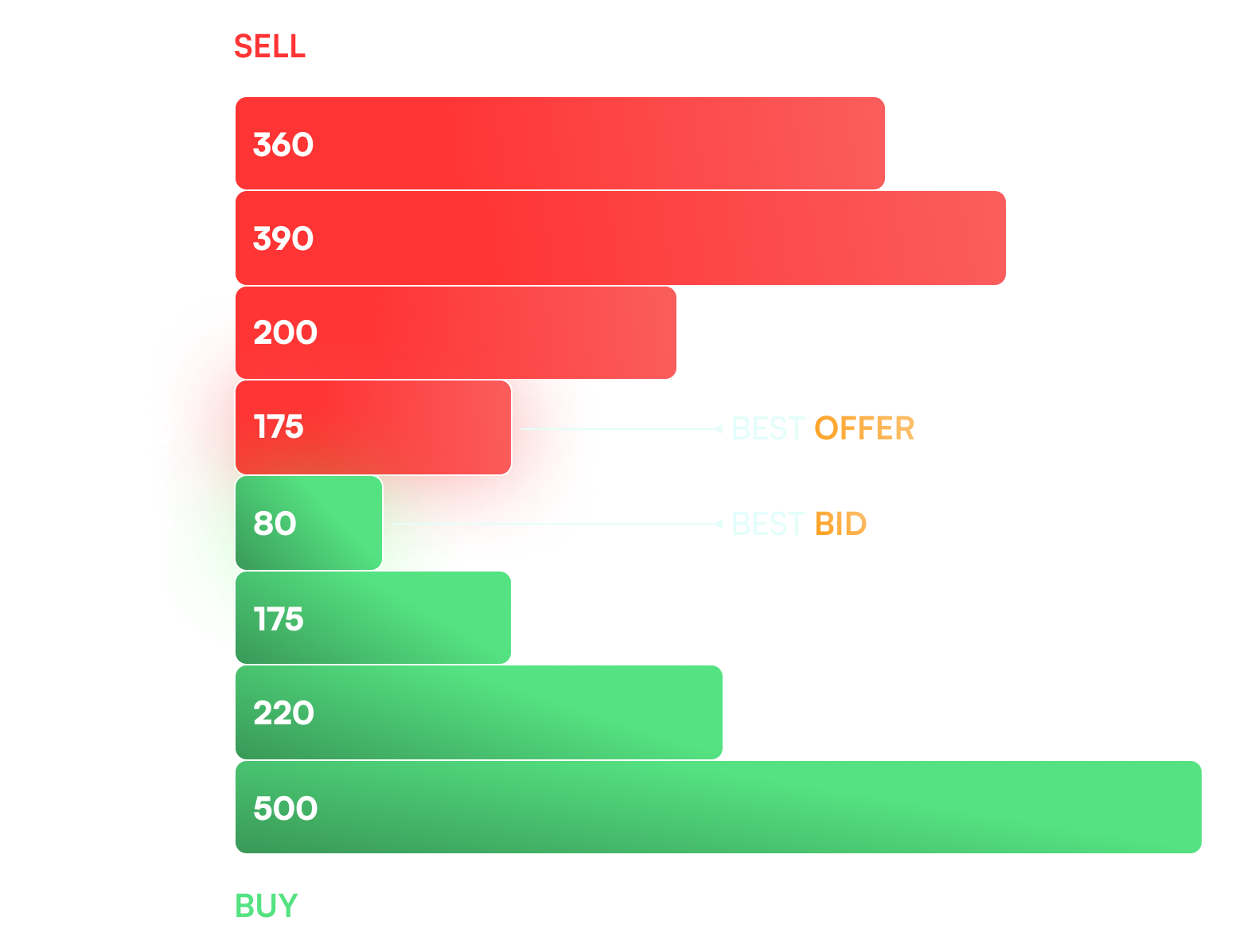

To get an idea of what Concentrated Liquidity offers we can compare it to a more centralized, and well-known, liquidity scheme: an Order Book.

In the depth chart above, bid (buys) and asks (sells) are clearly shown, and the depth at which a market order would impact the median price is visually discernible.

Shadow CL

Shadow is an orderbook-style AMM optimized for performant liquidity providers (LPs). By allowing LPs to concentrate their capital within specific price ranges, Shadow creates deep liquidity zones that mirror traditional orderbook depth charts, while maintaining the benefits of automated market making.

In a Uni V2 liquidity pair, liquidity positions are spread across a range from 0 to infinity (0,∞). This means that each liquidity provider must distribute their capital across every possible positive real number.

Liquidity spread from 0 to ∞ is exponentially less efficient than, say, one with a defined range of $3400-$3500. By focusing liquidity in a narrower range, concentrated liquidity pools can improve slippage, as more liquidity is available to support trades at desired prices, reducing the price impact of transactions.

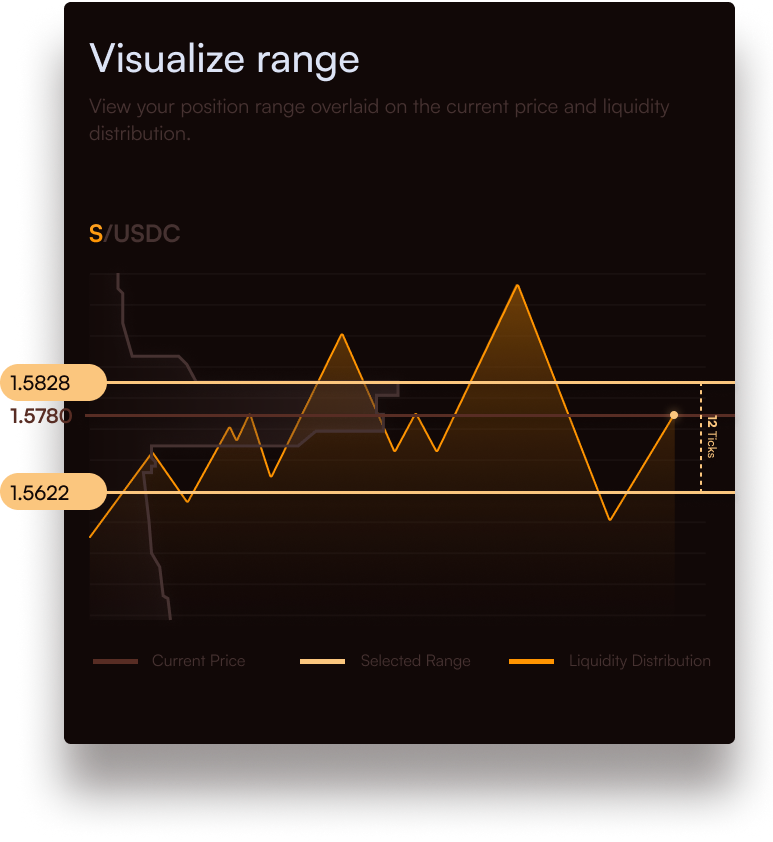

The yellow line represents the 7 day historical price range of the pool. This historical context helps liquidity providers visualize price volatility before selecting their position ranges.

The shaded area on the left represents the liquidity depth summed between all ticks within the liquidity pool (within the same fee-tier, more on this here).

The horizontal markers represent the range of the position. In the context of automated market makers (AMMs), the concept of a "range" refers to an interval between two ticks of any distance. The marker also displays number of ticks within the range.

Order Book View

Shadow has also introduced an Order Book View for users who want to provide liquidity in Concentrated Liquidity (CL) pools. This feature presents CL positions in a familiar traditional order book format, allowing users to create and manage liquidity positions more intuitively. For traders accustomed to order book–based trading, this significantly lowers the barrier to entry for participating in liquidity provision and managing positions effectively.

Alice and Bob

Let's explore how much better concentrated liquidity is for users, using: Alice and Bob.

Both Alice and Bob want to provide liquidity to an ETH / USDC pool. Each has $1,000,000 to invest, but they take different approaches:

| Alice's AMM Strategy | Bob's CL Strategy |

|---|---|

| Spreads her entire $1,000,000 across the full price range. Traditional "set it and forget it" strategy. | Allocates only $183,500 within the $3000-$4000 price range. Keeps remaining $816,500 for other opportunities. |

After 1 year with ETH ranging between $3000-$4000:

| If ETH / USDC price moves outside the range:

|

This example demonstrates why concentrated liquidity is effective—it achieves higher returns with significantly less capital at risk, while providing better pricing and lower slippage for traders.

Competitive Farming

Competitive farming is the method of rewarding the most productive and competitive liquidity with the highest returns. In concentrated liquidity models, users choose their liquidity ranges which they want to provide LP to. This opens the possibility for a user to choose any amount of tick ranges between 0 to ∞.

What are the benefits?

The more optimized a user's range is, the higher rewards they earn. This naturally aligns liquidity providers' interests with Shadow's growth and success. The goal of these incentives is to increase trading volume in pools, making them preferred routing destinations for aggregators. Concentrated liquidity is multiple times more efficient in bringing volume to a pool.

As trading volume grows, pools generate more rewards, which are distributed as real-yield to xSHADOW stakers.

How does this differ from other models?

Concentrated Liquidity outpaces Uniswap V2 liquidity 80-100x in terms of price execution, which leads to fees also increasing 80-100x. However the tighter a position, the more impermanent loss occurs. The goal for any user is to adjust positions consistently and often enough that the rewards outpace the risk.

Your efforts on Shadow are rewarded in full—the tighter your ranges, the more active your liquidity, the higher your earnings!

Range Orders

In orderbooks, anyone can easily set a limit order to buy or sell an asset at a predetermined price, allowing the order to be filled at an indeterminate time in the future.

With concentrated liquidity, you can approximate a limit order by providing a single asset as liquidity within a specific range. Like traditional limit orders, range orders are set with the expectation they will execute at some point in the future, with the target asset available for withdrawal after the spot price has crossed the full range of the order.

Important

Unlike some markets where limit orders may incur fees, the range order maker generates rewards while the order is filled. This is due to the range order technically being a form of liquidity provisioning rather than a typical swap.

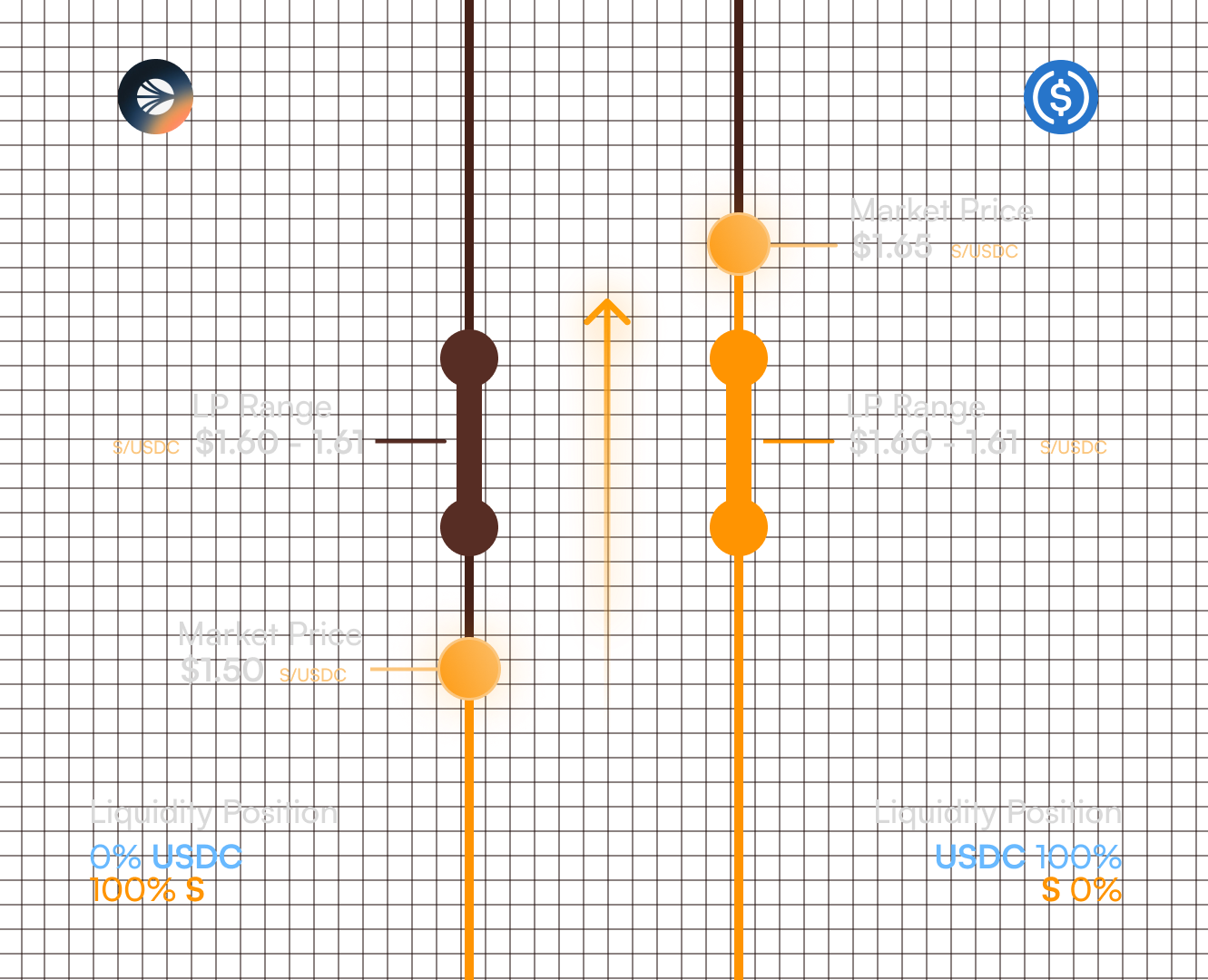

Take-Profit Order

Selling ETH for USDC

The current price of the ETH / USDC pool is $3300. You would like to sell your ETH for USDC when the price of ETH reaches $3400. This is possible, as the price space above the spot price is denominated in the higher valued asset, ETH. You can provide ETH at $3400-$3401 and have the order filled when the spot price crosses your position.

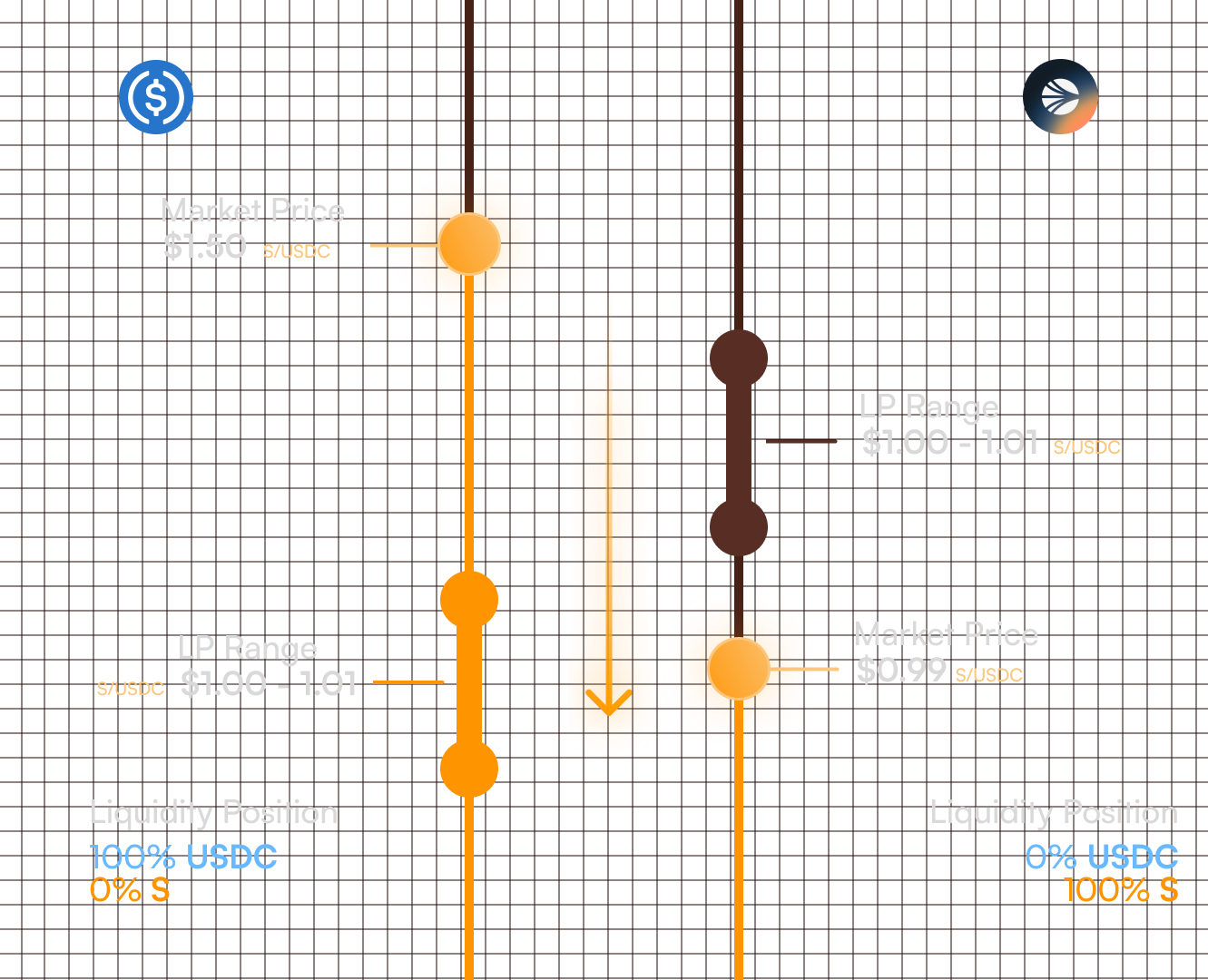

Buy Limit Order

Selling USDC for ETH

The current price of the ETH / USDC pool is $3450. You expect ETH to rebound if it ever drops to $3200. So you decide to provide USDC at $3200-$3201 and have the order filled if the spot price falls below your position at $3200-$3201.

Caution

Unlike traditional limit orders, range orders will be unfilled if the spot price crosses the given range and then reverses in the opposite direction before the target asset is withdrawn. While you will be earning LP rewards during this time, if the goal is to exit fully in the desired destination asset, you will need a tight range.

Impossible Range Order Types

| Buy Stop Orders | Stop-Loss Orders |

|---|---|

| Cannot place USDC orders above current price | Cannot place ETH orders below current price |

Pro Tip

When setting range orders, consider your concentration approach carefully. A wider range may generate more rewards during price fluctuations within your range, but increases the risk of having your order unfilled if the price reverses before completing your full range.

Fee Tiers

There are multiple default fee tiers when creating a Concentrated Liquidity position on Shadow:

| Fee Tier | Tickspacing | Best Used For |

|---|---|---|

| 0.01% | 1 | Highly correlated and pegged assets |

| 0.025% | 5 | Competitive asset classes with moderate volatility |

| 0.05% | 10 | Standard fee tier for most trading pools |

| 0.3% | 50 | Higher volatility assets |

| 1% | 100 | Exotic pairs with significant volatility |

| 2% | 200 | Highly volatile or illiquid assets |

Distribution

By default, swap fees are distributed according to the following global configuration:

- 100% - Distributed to xSHADOW voters (same to traditional liquidity pairs)

Important

These percentages can be configured per pool to better align with specific market conditions and liquidity requirements.